Expedited Payment

This demo project is part of the overall initiative of the Supply Chain Finance Community to create awareness of the Supply Chain Finance concept and its benefits, which will be demonstrated by means of a demo.

Introducing Reverse Factoring in the Transport Sector

The aim of the project is to introduce Reverse Factoring in the Logistical Sector. The logistical sector faces strong competition, low profit margins and an economic crisis on top. Financing the business has become both more difficult and more expensive and payment terms are often not respected. With the introduction of reverse factoring, liquidity should be released to those companies that need it.

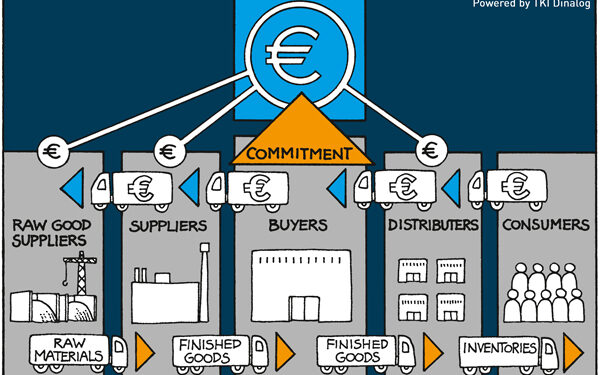

Resulting in Cheaper funding through the Buyer Credit Rating

The structure of reverse factoring works through the confirmation of the buyer (shipper) that certain invoices will be paid at a certain date. This confirmation is the collateral for other parties to finance the invoices from the transporter. The transporter pays a lower risk premium, as typically buyers have a better credit rating, and liquidity is provided in order to do business.

Creating Standard Contracts for SCF

To avoid the necessity for individual companies to discuss the set-up of such an arrangement, standard contracts (terms) are introduced such that all parties involved know the rules of the game. Within the project, effort will be put in making sure that both shippers/transporters/financing parties agree to the set up to make this introduction work from the start.

Following International Standards for maximum impact

Even though the project is started with a clear focus on a single sector in the Netherlands, international standards are used to allow for project results to be copied/used in other sectors and/or countries.